Existing Home Sales Improve

The conflicts in Ukraine and the Middle East had little impact on markets this week, while the economic data was slightly stronger than expected overall. As a result, mortgage rates ended the week a little higher.

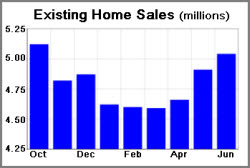

The housing data released this week contained mixed news. Fortunately, the good news came from Existing Home Sales, which cover roughly 90% of the housing market. June Existing Home Sales rose 3% from May to the highest level since October 2013, marking the third straight month of increases. Also, the inventory of existing homes for sale rose to the highest level since August 2012.

Less encouraging, June New Home Sales, accounting for the remaining 10% of the market, declined 8% from May, and the May results were revised sharply lower. These figures are frequently volatile from month to month. New homes inventories increased as well to the highest level since October 2011. To summarize, the bulk of the housing market showed continued improvement, and the tight supply of homes for sale in some markets may be showing signs of easing.

While Fed officials have recently downplayed the risk of higher inflation, many investors are not quite so certain. The inflation data released on Tuesday eased some concerns, but just slightly. The June Consumer Price Index (CPI), one of the most widely watched inflation indicators, increased at a 2.1% annual rate. Core CPI, which excludes the volatile food and energy components, was 1.9% higher than one year ago. With CPI holding steady close to the Fed’s stated target level of 2.0%, investors will be keeping an eye out for signs of rising inflation which could pressure the Fed to tighten monetary policy.

Next week, investors will be watching both geopolitical events around the world and major economic news in the US. The next Fed meeting will take place on Wednesday. The first reading for second quarter GDP, the broadest measure of economic growth, also will come out on Wednesday. The important monthlyEmployment report will be released on Friday. As usual, this data on the number of jobs, the Unemployment Rate, and wage inflation will be the most highly anticipated economic data of the month. Core PCE inflation, ISM Manufacturing, Pending Home Sales, and many other reports will round out a very busy week. In addition, there will be Treasury auctions on Monday, Tuesday, and Wednesday.