But a deeper look at the market reveals a recovery divided between the rich and everyone else.

The market for high-dollar homes is hopping, with sales on the rise and buyers launching bidding wars. But sales of low- to medium-priced homes have plummeted during the same period — with many potential buyers priced out.

“Housing affordability is really taking a bite out of the market,” said Leslie Appleton-Young, chief economist for the California Assn. of Realtors. “We haven’t seen this issue since 2007.”

The median price across the six-county region jumped 4.5% from $383,000 in February, according to San Diego-based DataQuick — the first significant increase since prices stalled last summer after a sharp run-up. But the number of homes sold fell sharply from 2013, down 14.3%, to the second-lowest total for a March in nearly two decades.

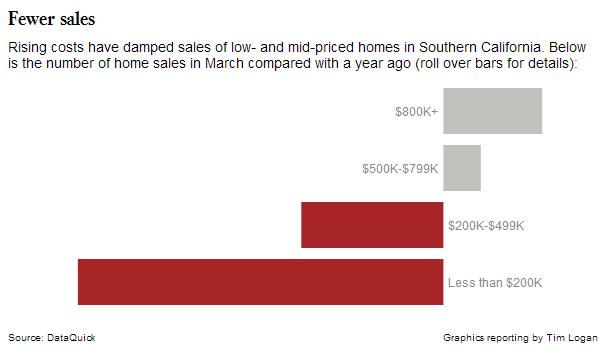

Those declines came even as sales of high-end homes increased. Sales of homes costing $800,000 or more grew 12%, while sales of homes costing less than $500,000 fell at twice that rate.

A number of factors have sapped demand, Appleton-Young said. Lending standards remain much tighter than during the housing bubble of the last decade. With wage growth stagnant, most middle-income families aren’t seeing more money in their paychecks. Add in issues such as rising student loan debt, and the mortgage payment becomes that much harder to afford.

“I think first-time buyers getting financing is going to become more of an issue,” she said.

Carey Chenoski, a real estate agent in Redlands, said she has seen less interest in homes for sale lately as first-time buyers struggle to afford the new higher prices. There are more homes on the market than last year — which is keeping further price growth in check — but they’re not selling.

“Lately on Saturdays and Sundays, you see open house signs everywhere,” she said. “The houses that last spring would be gone in the first day are sitting maybe 60 days.”

That, in turn, is frustrating some sellers. Chenoski recently saw the price on a three-bedroom in Redlands reduced to $299,000 from $315,000 — and it still didn’t sell. So it was taken off the market.

It’s a different story in pricier pockets of the region, where high-end sales are climbing, all-cash offers remain common, and well-priced homes go fast.

“We’re getting multiple offers on just about everything,” said Barry Sulpor, an agent with Shorewood Realtors in Manhattan Beach, where he said there is a new wave of tear-downs and new construction in prime beachfront locations. “The market is really on fire.”

This imbalance between different slices of the market is a hangover of the housing crash, said Dave Emerson, a longtime agent in Lakewood who recently retired. The higher end suffered fewer foreclosures and returned to health faster. At the lower end, prices mostly bounced back. But amid tougher lending standards, a still-shaky economy and, more recently, rising interest rates, buyers haven’t necessarily followed….

CONTINUE READING HERE….